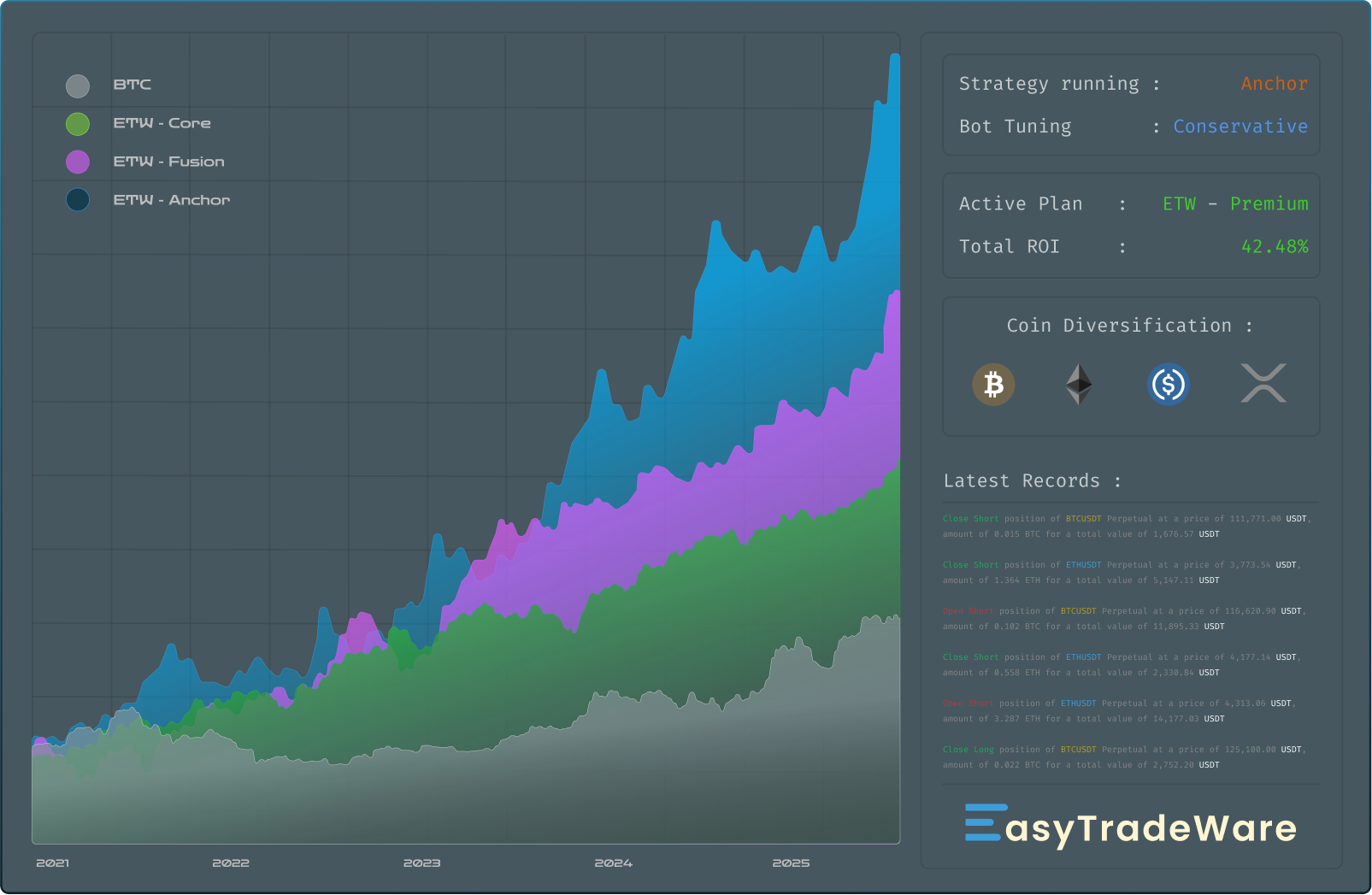

Institutional - Grade Systematic Crypto Investing

ETW is a hedge-fund style, multi-strategy engine, delivering long-term, risk-adjusted performance, without taking custody of your assets.

Integrations with Leading Crypto Exchanges & Platforms

Our Strategic Approach

ETW's strategies are not just simple bots. They are a diversified suite of proprietary models, each designed to harness different market dynamics.

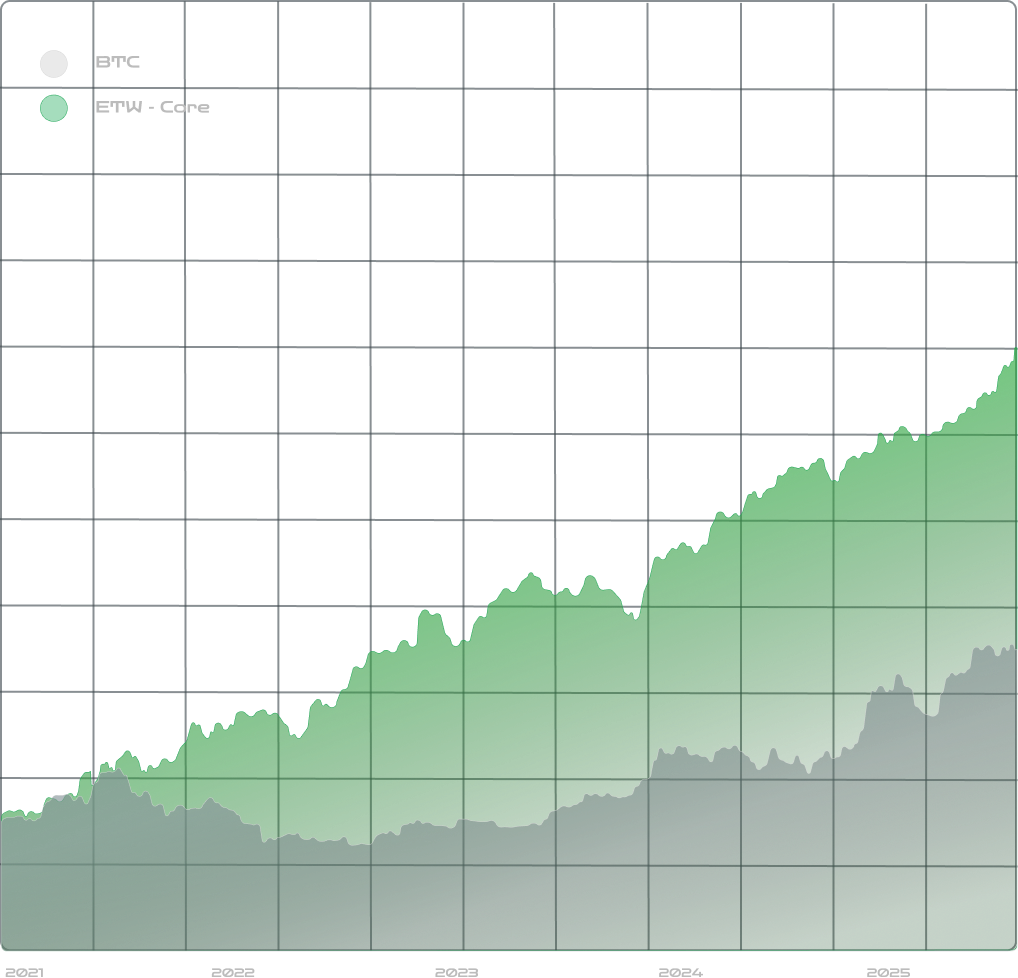

Core

Alpha Trend Capture

Philosophy

Cut losses early, Let winners run.

About

A systematic, volatility-adaptive trend-following strategy built to capture both long and short moves. It operates across uptrends, downtrends, and high-volatility phases.

Works best in

Sustained directional markets (bullish or bearish).

Risk Frameworks

Vol-scaled position sizing, Initial & Trailing stops.

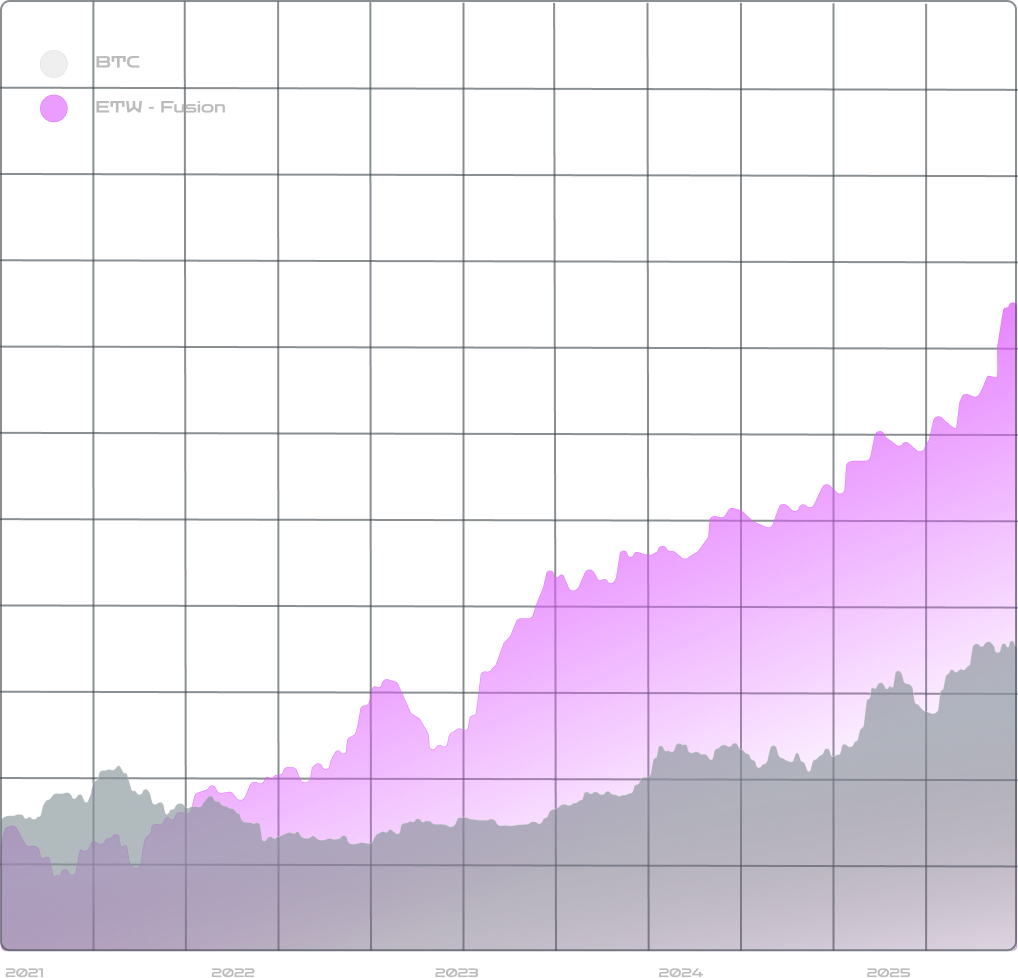

Fusion

Range-Expansion Breakout

Philosophy

Compression → expansion is the edge. We act on confirmed breaks, not opinions.

About

A systematic long/short breakout strategy that engages when price pushes decisively beyond a recently established range.

Works best in

Post-consolidation breakouts (up or down)

Risk frameworks

Threshold filters, Stop-loss, Trailing stop, Time-outs for failed breaks.

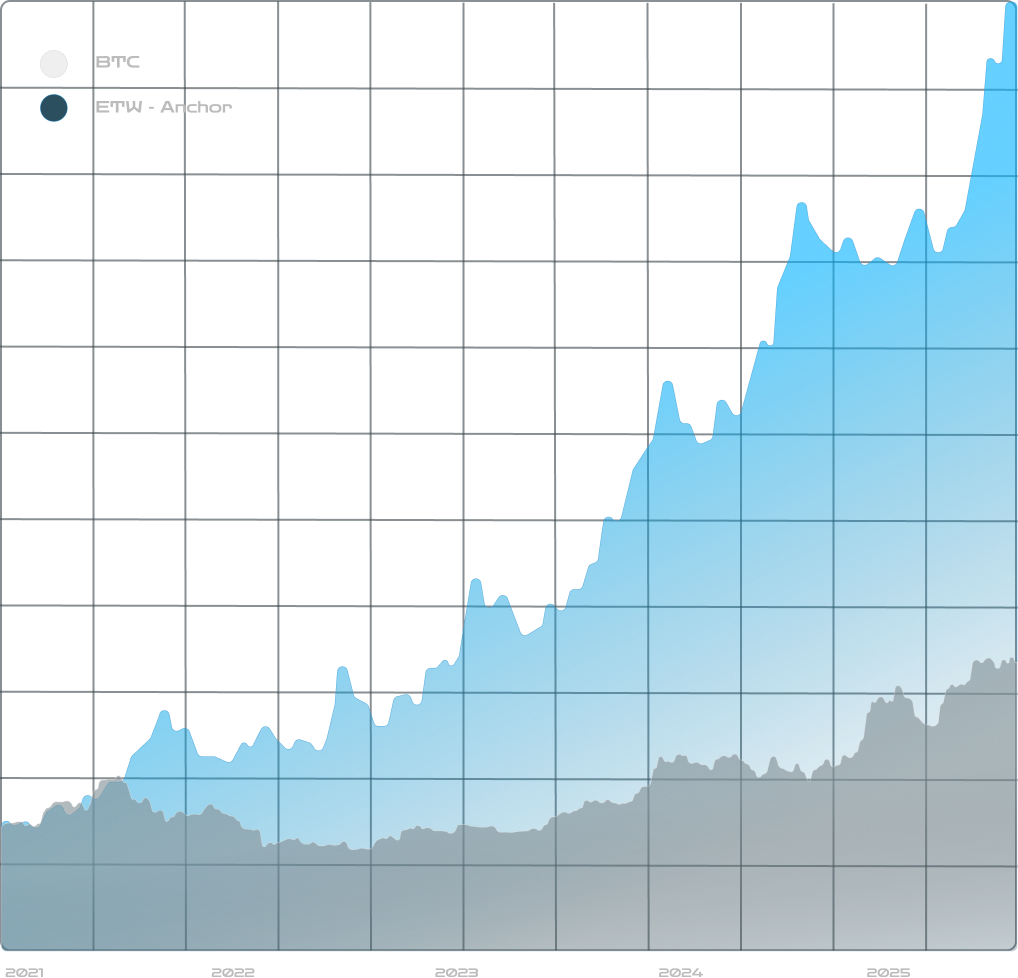

Anchor

Long Only (Spot)

Philosophy

Participate in market-cap growth while actively managing downside risk in spot markets.

About

A long-only crypto strategy focused on a diversified basket of top-cap assets that pass our liquidity and quality screens. It seeks to participate in uptrends while systematically cutting risk.

Works best in

Broad market uptrends with leadership concentration.

Risk frameworks

Rebalance Cadence, De-risk Triggers, Position & Asset-level stops

How ETW makes Crypto Investing Easy for Everyone

Unlock institutional-grade performance with a platform engineered for risk management, discipline, and results. We empower crypto investors by transforming complex market dynamics into a streamlined, automated process.

Automated, Algorithmic Execution

ETW runs systematic, algorithmic strategies that follow predefined rules, removing emotion from trading

24/7 Adaptive Trading Engine

The engine monitors markets around the clock and adjusts exposures in real time to price action and trend shifts.

Intelligent Risk Architecture

Stop-loss logic, position sizing, volatility targeting, and periodic rebalancing aim to improve risk-adjusted outcomes across cycles.

Research-Driven and Backtested

Our strategies are born from quantitative research and are rigorously backtested against historical data.

Seamless Multi-Exchange Integration

API integrations with major exchanges enable diversified execution and deeper liquidity, while you retain assets in your own accounts.

Non-Custodial by Design

Orders are placed via secure exchange APIs with withdrawal permissions disabled for transparency and control.

Bot Tuning

Choose from our advanced bot tunings, each designed for different market conditions and risk profiles.

Conservative

Capital Preservation

- Behaviour : For investors who prioritise smaller drawdowns and steadier equity curves.

- Turnover : Low-moderate

- Who it's for : Long-term allocators, first-time systematic users

- Universe : BTC + screened top-liquidity alts

Balanced

Core Diversified

- Behaviour : Moderate volatility, diversifies signal sources to reduce regime risk

- Turnover : Moderate

- Who it's for : Investors seeking a single core sleeve for crypto exposure

- Universe : BTC + screened Top-50

Volatility Capture

Exponential Growth

- Behaviour : For investors comfortable with higher swings to pursue larger upside.

- Turnover : Moderate-high

- Who it's for : Experienced investors who accept higher drawdowns for potential growth

- Universe : BTC + screened Top-50

Simple Steps to Start

Get up and running in minutes with our streamlined onboarding process

01. Choose Your Plan

Subscription or performance plan

02. Connect Your Exchange

Securely link your exchange account via API

03. Choose Your Strategy

Based on volatility, logic, and collateral preferences

04. Enjoy The Ride

24/7 build your wealth for the long term