The Institutional Gateway to Digital Asset Growth

Access multi-strategy alpha engines, tailored risk frameworks, and a scalable white-label platform

Institutional grade Discipline and infrastructure

ETW brings the rigour of hedge-fund-style systematic strategies into a framework that's as easy to integrate

Multi-Strategy portfolio, Regime-Adaptive Alpha

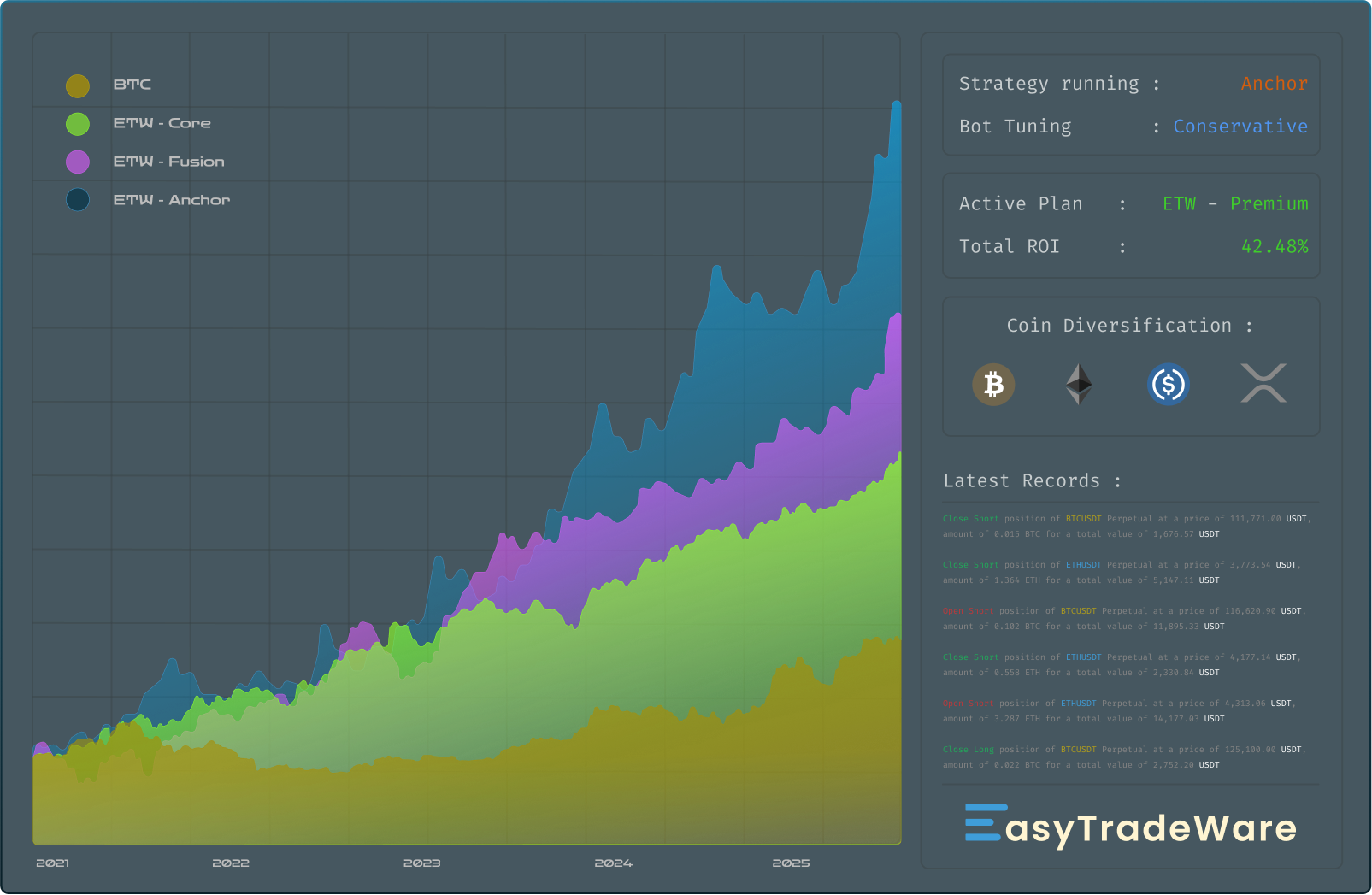

Our strategies are not just trend followers-they're multi-horizon, uncorrelated sleeves designed to perform across different regimes. Institutions gain access to a resilient alpha engine that reduces reliance on single-style risk.

Non-Custodial + Governance Ready

Assets stay in clients' existing exchange accounts, while ETW executes through trade-only APIs. For HNIs, this ensures custody never leaves their name, while institutions get built-in compliance alignment with global custody rules.

Custom Risk & Compliance Overlays

Institutions can embed their own risk parameters into ETW's engine, including coin allowlists/blacklists, exposure caps, drawdown thresholds, and trading windows. This makes ETW policy-compliant, regulator-friendly, and investor-trustworthy.

Transparency & Reporting Built for Audits

From real-time dashboards to API-level reporting, ETW delivers the kind of transparency HNIs and regulators demand. Every fill, exposure, slippage, and P&L is logged, auditable, and ready for investor statements.

Scalable Partnership Models

Whether you are a hedge fund seeking SMA sleeves, a family office outsourcing crypto allocation, or an exchange monetising users via automated investing, ETW's partnership models are flexible and scalable.

We offer Two Solutions

SMA Solution

Deploy capital into non-custodial, rule-based portfolios via ETW's trading engine.

-

Ready-to-deploy strategies with further customization possible.

-

Collateral options: Stablecoins (USDT/USDC)

-

Subscription: Performance-based billing, depending on tier.

-

Live monitoring of trades and portfolio.

-

Drawdown controls, trend filters, and volatility-based sizing for risk management.

Ideal for: HNIs, Hedge funds, Family offices seeking disciplined long-term exposure without custody risk.

White Label Solution

Offer automated crypto portfolios under your own brand. Use ETW's multi-strategy sleeves or onboard your own strategies, without investing millions into building and maintaining infrastructure.

-

Your branding, ETW's non-custodial trading engine.

-

Supports ETW strategies or partner-developed custom sleeves.

-

Modular, API-ready infrastructure for seamless integration.

-

Compliance-friendly: assets remain in client-owned exchange accounts.

Ideal for: Advisory firms, Trading desks, Proprietary trading groups, and Algorithmic platforms.